Ah yes, the age-old ‘Fixed vs Variable’ debate when it comes to mortgages…

Analysis from one of our top lenders:

“There is the notion that the big, trend-setting lenders will be looking to move (fixed) rates up to bolster profits. As well, Bank of Canada Governor Stephen Poloz has hinted he might be willing to let inflation run in order to avoid hiking the policy rate. That would put upward pressure on government bond yields (Also affecting fixed rates). As for variable-rate mortgages, the betting is there will not be a Bank of Canada increase, holding variable rates in place for the foreseeable future.”

You read what the above quote is essentially saying right? Fixed rates are where banks etc. can turn to and manipulate to boost profits. Profits are good if you are a shareholder of a bank. Profits aren’t as cool if you happen to hold a borrowing instrument from one of those same banks. There’s a big reason that most banks aren’t rushing to market and push variable rate mortgages even though almost every one of them definitely has this in their arsenal. The reason is because variable mortgages typically favor the customer, or at least aren’t AS profitable as the fixed rate option.

Here’s an informative blog that a colleague of mine wrote: https://dominionlending.ca/news/top-4-reasons-why-a-variable-rate-mortgage-can-put-you-further-ahead/

In particular, the point that I find most relevant is the penalty calculation, usually a point that isn’t even brought up in the original mortgage application process. On a variable rate, the maximum penalty that can be charged is 3 months interest, in your guys case likely less than $2000 and a pretty basic calculation. A fixed penalty is a different beast altogether. The penalty on a fixed is the GREATER OF 3 months interest or a dreaded Interest Rate Differential (IRD) calculation. The IRD can be very punitive (I’ve seen over $20,000) and very difficult to calculate as it is based on bank posted or bond rates which change daily.

Here’s another colleague blog post that I like as it’s short, sweet and to the point: http://bit.ly/ARMvsFixed

My summary – Don’t believe media fear mongering suggesting to “lock in now or else!” whenever these headlines pop up. A variable rate strategy can be a very strong move to hammer down principal on your mortgage over the next 12-18 months.

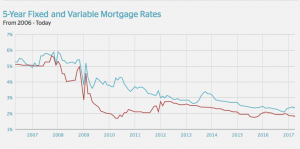

Consider the strategy where we set your payment to what you’d pay on the higher fixed rate — all that extra money goes direct to principal. Net result, when / if rates rise, your balance is significantly lower and your budget already fits the rate increase. Despite what some publications would have you believe, rate increases are gradual and should not drastically affect most people’s cash flow situation. Sure your rate could be higher than present day fixed rates years down the road. This is no different than saying putting your money in GICs could produce a better result than investing in Apple stock. I’m willing to bet (and I have with my own personal mortgages) however, that the savings / net worth improvement that can result in the next 12-18 months plus added flexibility in reduced costs/penalties related to variable mortgages wins out over fixed in almost all circumstances. Decades of financial data on mortgage rates in Canada support variable mortgages consistently beating fixed, often by a large margin: (NOTE: Blue=fixed / Red=Variable)

Mortgage product selection is one small aspect of the value that an independent mortgage professional can offer clients. A licensed mortgage professional should bring more to the table than simply an approval and a low rate. By reviewing our client’s entire financial picture and outlook, we help build a plan that best aligns with the individual borrower’s goals & saves the most money overall on your mortgage, now and in the future.