One of the best parts about life is that it is ever-changing. This is one of the reasons that mortgages are available on term contracts (such as the standard 5-year) – so that you can adjust your mortgage over time to best suit your needs. However, in some cases, life changes and you cannot wait until the term is up. In fact, roughly six out of ten homeowners with the standard five-year mortgage break their terms within three years!!

There are a variety of reasons to refinance your mortgage such as wanting to leverage large increases in property value or get equity out of the home for renovations. In some cases, you may be unable to wait until the term is up due to life events such as marriage, growing family, a new career, kids going off to college, divorce, or needing to consolidate debt.

Before you refinance your mortgage, it is important to understand that if you do this during your current term, you will be breaking your mortgage agreement and there can be penalties that come with that.

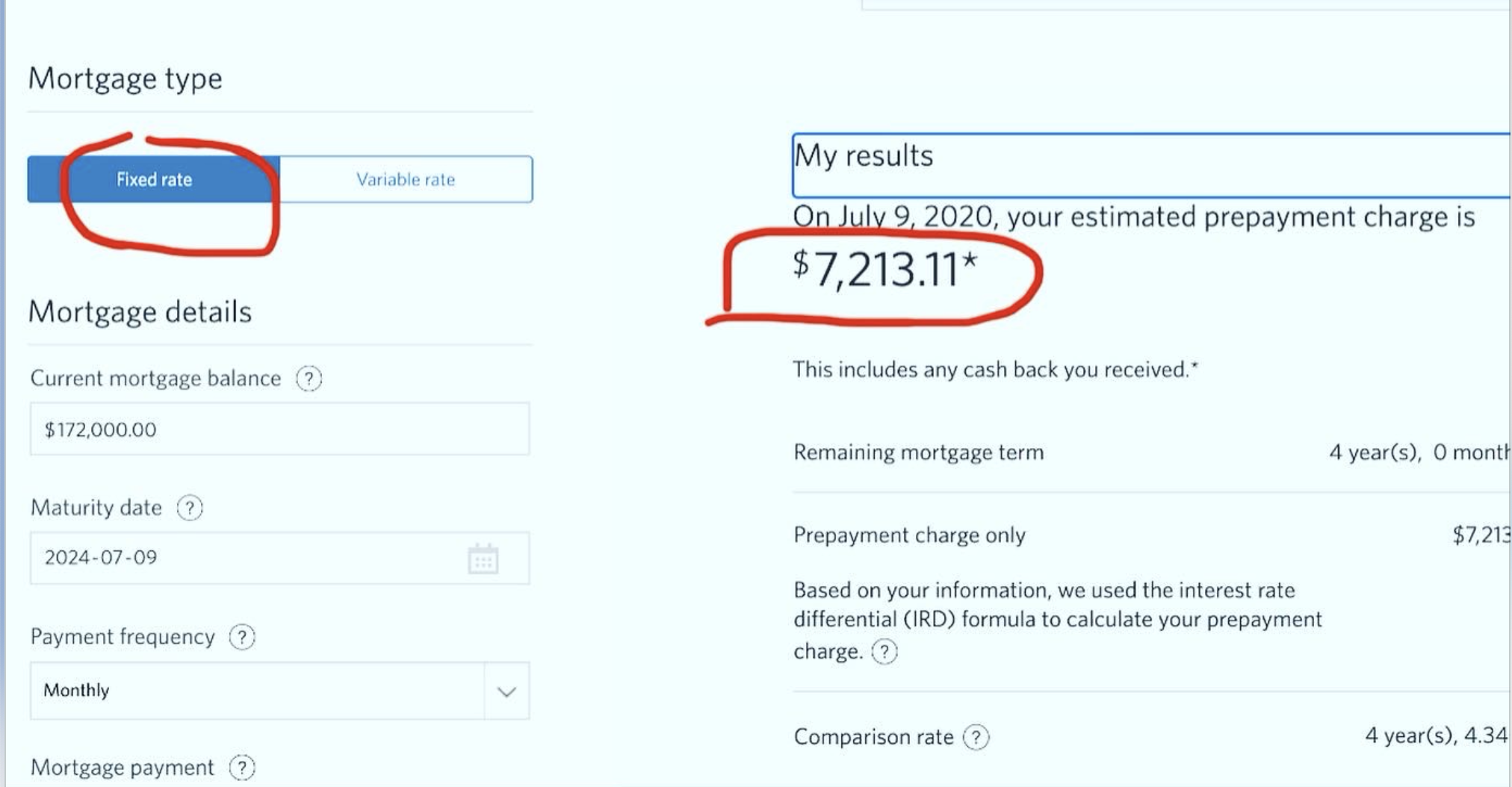

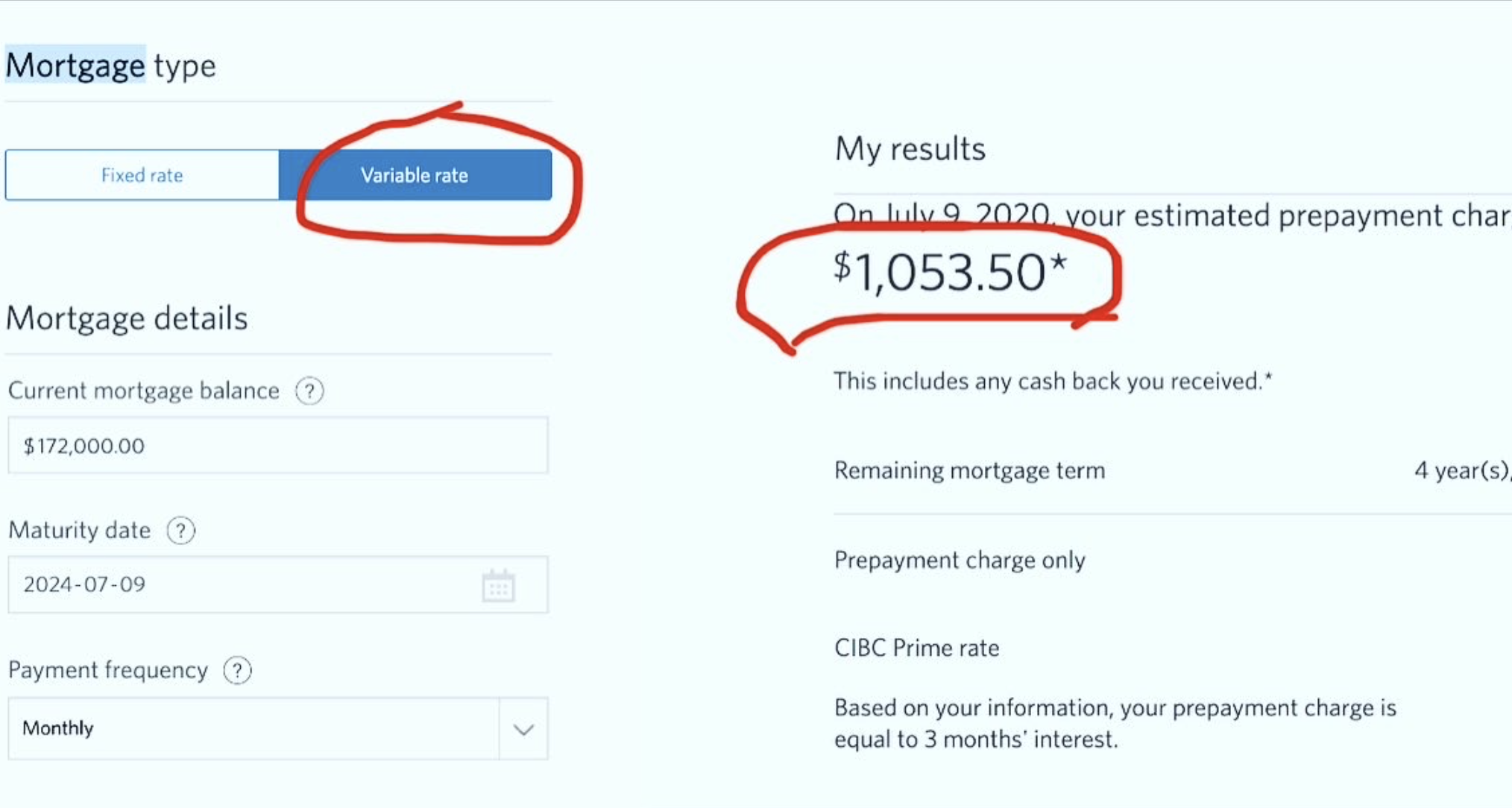

If you cannot wait, it is important to understand how your lender is going to calculate the penalty for breaking the mortgage. Canada’s big banks calculate mortgage penalties based on the discount you were given from the posted rate at the time that you signed your mortgage agreement. Generally speaking, the penalty for breaking a fixed rate mortgage can be quite hefty in relation to a variable / adjustable mortgage, especially if that fixed mortgage is through one of the chartered banks in Canada. I’ve blogged about mortgage penalties previously.

Beyond the penalties, there are a few other points to consider before refinancing:

- You can typically tap into 80% of the current market value of your home

- You cannot qualify for default insurance on a refinance which can limit your lender choice or lead to a higher interest rate than might be available on a purchase

- You would have to re-qualify under the current rates and rules – including passing the “stress test” again.

So what can you do? There is an option to sign a fixed mortgage for a shorter term, such as three years, but life has a funny way of not working with specific calendars, regardless of how meticulous you think you can plan & organize your life. You can also consider a variable rate from the start, as the penalties for breaking these mortgages are much lower.

Talking to a mortgage broker about refinancing can provide you access to lender options and help map-out plans to best suit your needs and what you are trying to accomplish through your refinancing strategy.

BENEFITS OF REFINANCING

Regardless of why you are looking to refinance, it can come with a host of benefits when done properly!

1. A Lower Interest Rate

Depending on where you are in your mortgage term, you could refinance to get a better rate – especially when done through a mortgage broker. On average, a mortgage broker has access to 90 lenders and is able to find you the best rate versus traditional banks which only have access to their own rate.

2. Consolidating Debt

When it comes to debt, there are many different types — from credit cards to lines of credit to student loans to mortgages. Most types of consumer debt have much higher interest rates than those you would pay on a mortgage. Refinancing can free up cash to help you pay out these debts. While it may increase your mortgage balance, your overall payments could be far lower and would be a single payment versus multiple sources. Keep in mind, you need at least 20 percent equity in your home to qualify.

3. Modifying Your Mortgage

The beauty of life is that it is ever-changing and sometimes you need to pay off your mortgage quicker or change your mortgage type. Maybe you came into some extra money and want to put it towards your mortgage or maybe you are weary of the market and want to extend your amortization and lower payments for cash flow security. It is always best refinance when your mortgage term is up, but life doesn’t always align that way. We can discuss what potential penalties / costs might look like if waiting is not possible.

4. Utilize Your Home Equity

One of the major reasons to buy in the first place is to build up equity in your home. Home equity as the difference between your property’s market value and the balance of your mortgage. If you need funds, you can refinance your mortgage to access up to 80% of your home’s appraised value in cash!

When you are considering refinancing your home, or wondering if it is the best option for you, don’t hesitate to reach out to me for expert advice!