“A Variable rate mortgage? Too risky for me!!”

This is probably one of the most frequent, and most costly misconceptions I see in mortgages.

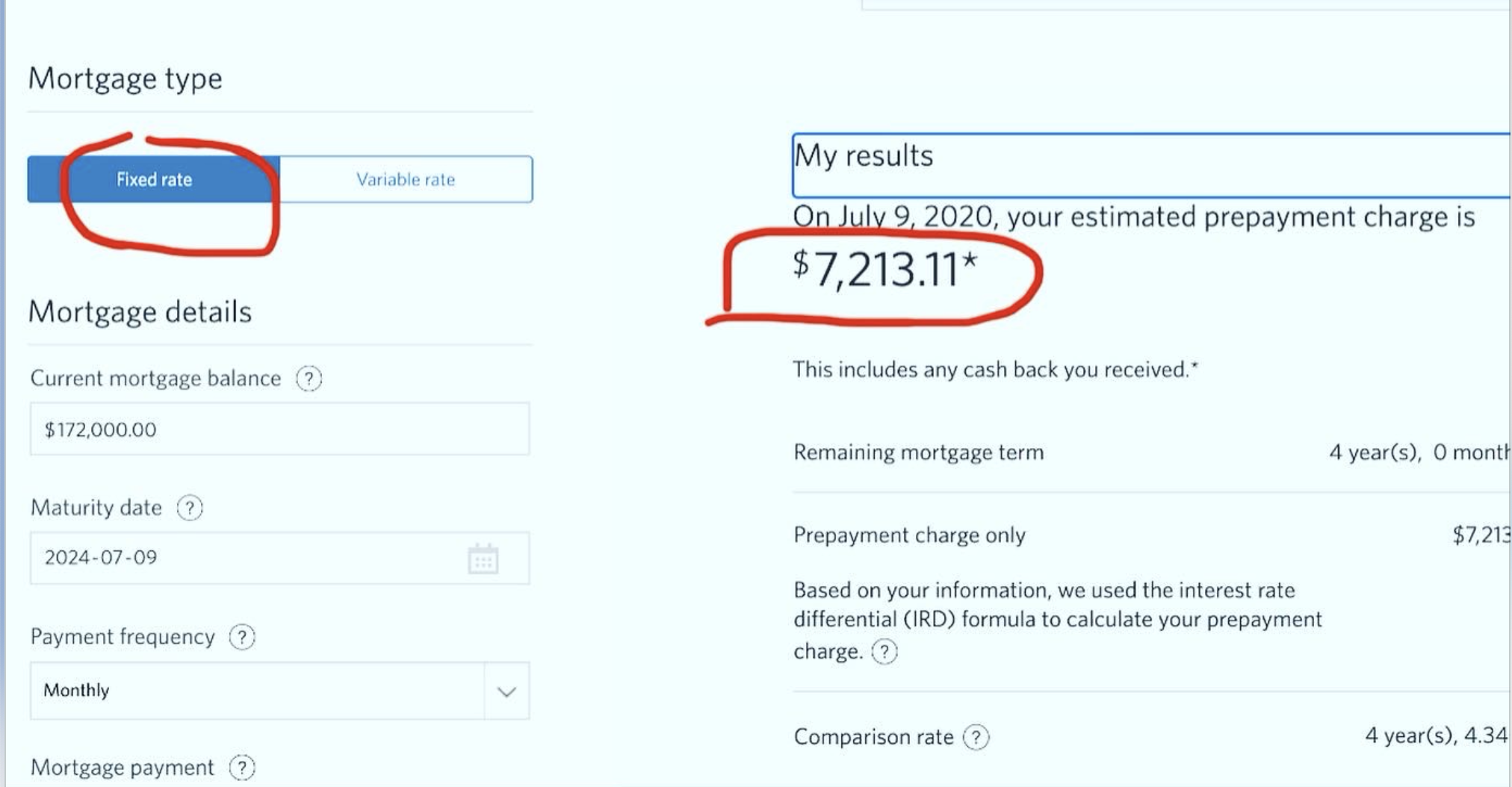

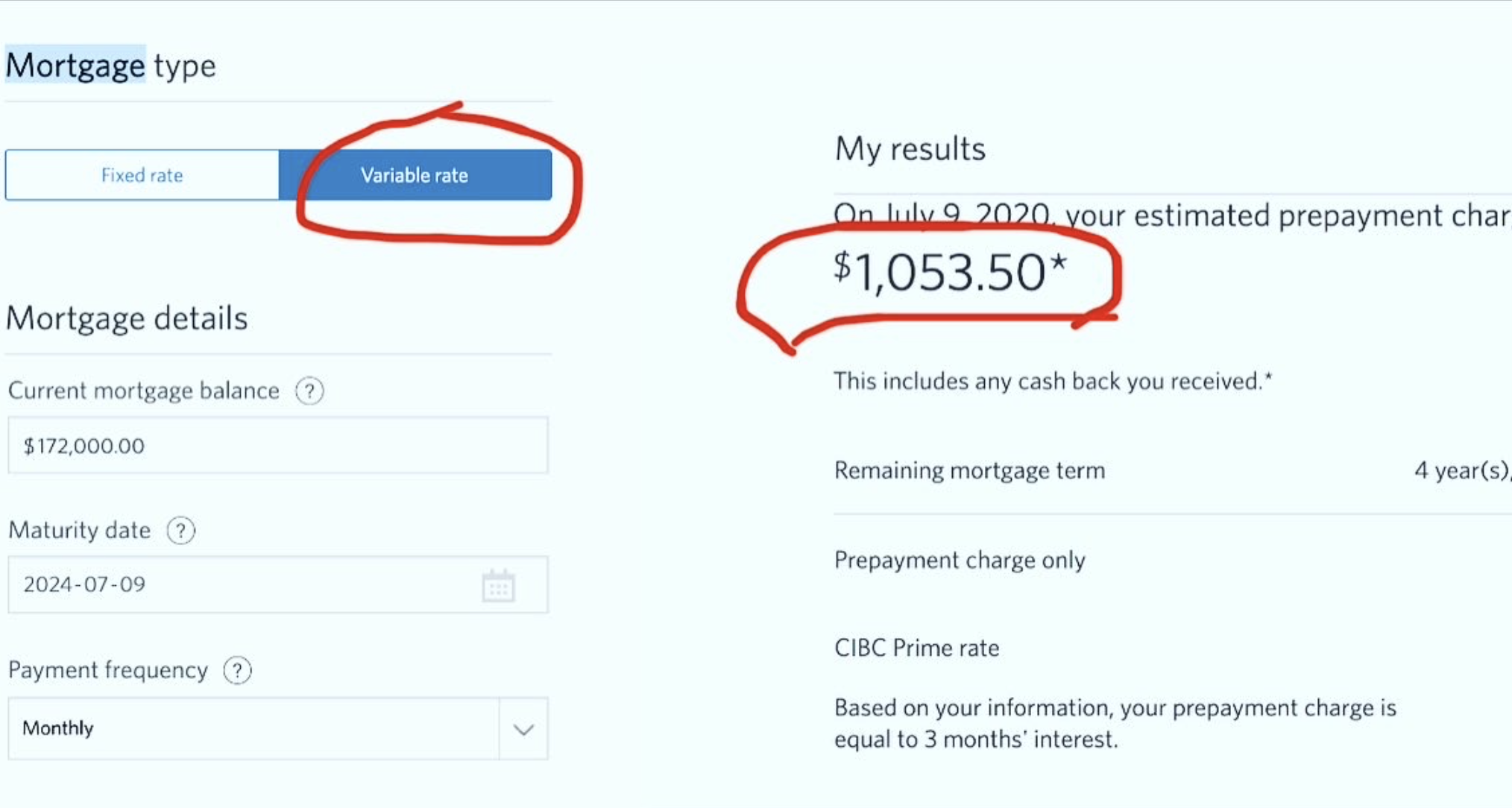

The true risk of a mortgage is in erosion of a family’s net worth. I’m not talking erosion caused by a $25-50 change in a person’s payment when Bank Prime rate changes. I’m talking erosion caused by a payout penalty that can be 4 to 10 times higher (or more) than another available option. Check the two pics showing the identical mortgage, the only difference, one is a FIXED rate, one is ADJUSTABLE / VARIABLE rate:

Fixed rate example

Adjustable / Variable rate example

The fixed mortgage penalty (top) is 7 times that of the adjustable mortgage and over 4% of the total mortgage amount. That’s on a $172,000 mortgage. Imagine what that penalty looks like on a $650,000 mortgage!

In 14 years of doing mortgages, I am here to tell you that LIFE HAPPENS! The best laid plans, strategies and goals can be undone by a single change of course along the journey.

The smartest, most prepared, most informed people get transferred, get promoted, get sick, get divorced, start businesses, have children etc. Often this requires or results in a recalibration of their current mortgage financing.

In most cases, the chartered banks have the MOST punitive / harmful penalty calculations. If you knew how much money banks put on their “other fees & charges” revenue line due to early payout fees annually you would be shocked. It’s honestly crazy that such high penalties are even allowable. Statistics show that over 70% of 5 year mortgages are broken prior to their maturity. The average lifespan of a mortgage is 3.7 years before being broken or changed. And banks know this as well. The five year fixed mortgage is indeed the safest mortgage available – to the bank shareholders! The true risk in mortgages lies in rolling the dice with less than 30% odds that you will see a 5 year term through to its maturity.

I use the saying (borrowed from an esteemed colleague) – “Life is variable, your mortgage should be too!” It has served many of my clients (myself included) very well over the years.

Bottom line

Of course, the entire picture has to be known before a professional can properly determine which mortgage option fits one person / family’s circumstances. In some cases, the peace of mind that goes along with a Fixed rate is, in fact, a preferred option. In our role, we do our best to ensure that if the mortgage is to be set up with a fixed rate, that we align with a fair-penalty lender. That is the value and advantage of working with dozens of lending institutions. We can sidestep lenders that are known to have much more consequential penalties than others.

As a Mortgage Professional, my goal is to help manage the overall risk of your mortgage. We don’t want you to take on more risk than you are comfortable with by any means. Just want to make sure you don’t drive into the ditch trying to avoid a pothole!